tldr: Building a strong personal finance base is key financial independence.

Financial independence is incredibly important to me. It has been for as long as I can remember. However the term “financial independence” is illusive at times and I’m quite aware how much it’s thrown around by well meaning influencers that unfortunately fail to provide any meaningful steps in it’s attainment.

I’d be kidding myself if I said that I was financially independent in it’s truest sense as I still actively work to produce income. It’s a pursuit that my partner and I take more seriously every year. As we have slowly moved ahead over the years, one thing has become apparent – you must build a strong financial base in order to make any kind of progress.

It’s incredibly tempting to have “shiny object syndrome” and go after anything and everything that seems to produce a quick win. However at the end of the day, taking advantage of opportunities (whatever they may be) needs to come from a position of strength, not weakness. Spending your last dollar on a get rich quick scheme isn’t investing, it’s gambling. It’s done out of fear and it rarely pays off. In fact, if it does pay off you may as well throw the money away as the lesson you just learned isn’t a good one.

Building a strong personal finance base is key to all other financial progress, period.

I’d like to discuss some key areas of financial independence that you can use, review and improve right away. I hope it’s a value add to your day and life.

Financial Independence Principles

In order to make progress physically, you must first make it mentally. Here are some principles you can adopt to level up:

Prioritization and long term focus

Getting better at focusing on what’s important can really help when it comes to cleaning up and improving your finances. In fact, a large part of the reason that most people fall behind is simply because they are unorganized and unfocussed.

People say that obsession is unhealthy, I say it’s a necessity if you really want something. You need to become obsessed with prioritization and the end goal. Keep your financial independence goals clearly in mind. They will help to guide all the smaller decisions that happen in between.

Critical Thinking / Assessment

Thinking critically about your finances seems like a daunting activity. Like anything though, we get used to it over time and change our habits. Assessing and thinking more frequently about not only your current expenses, debts, savings & income, but the impact of future choices is a key difference between success and failure. Practice questioning the cost of things without feeling embarrassed or guilty. Don’t be afraid to ask for a discount if you think you are paying too much.

Really step back and assess your life as if you were assessing a business – the business of you.

This can be uncomfortable and difficult, but remember that growth is always on the other side of discomfort. Keep this in mind and you will start to see “difficult” differently.

Delayed Gratification / Restraint

To increase your net worth, you must learn to delay purchasing non-wealth-building items until you have reached your monthly savings or debt repayment targets. Delayed gratification is the term we use to hold yourself back from just buying things because you want them.

Practicing minimalism can help with this. Changing your mindset around what matters can help as well. Get more excited about having money than having “things” and you are moving in the right direction.

The good thing is that while this might seem strange at the beginning, you are going to be surprised how soon your desires for “things” die out. The material things you once desired and the people you once admired soon turn. You might be even more surprised to hear that you will begin to pity those trapped inside their material jails with little hope of escaping their own short term desires for “things”.

Don’t get me wrong, I am far from cheap myself. We buy nice things, but we buy we wait for sales, we buy high quality and we only buy when it has little to no impact on our investing and savings goals. Its a key difference.

If the purchase of something threatens a financial goal, I don’t want it.

Practical Budgeting for Financial Independence

Budgets aren’t sexy, but they can be can help you feel organized, in control and purposeful. They also achieve goals. To improve, you need to measure. A budget is your measuring tape here.

The best way to tackle a budget is by categorizing things, so you understand where your spending happens (both on paper and in your mind).

Consider this a data gathering activity first, rather than judging yourself. After you have gathered data, you can assess and improve.

Here are our personal categories as a couple:

- Food (groceries, eating out, alcohol, takeaway)

- Healthcare (chemist stuff, vitamins, health insurance etc)

- Pets (food, vet, toys, treats, maintenance)

- Utilities (phone, electrical, water, gas, streaming services, ambulance etc)

- Transport (public transport, hire cars, services, insurance, fuel, tolls, registration etc)

- Rent or Mortgage

- Investment expenses (you can use a separate spreadsheet for something like an investment property)

- Investment savings (Yes, I classify this as a non-negotiable expense and invest each month)

Don’t forget to also track the other side of the equation – your income. Include all streams and measure everything.

After gathering data, you need to find ways to reduce expenses and increase income. Its as simple as it sounds, but practically you will need to take action. Start a side gig for more cash or call your utility providers and ask for discounts.

Do whatever it takes to increase the gap between income and expenses. The gap (surplus) is where the magic happens for savings and investing later.

Debt Reduction

Let me give you 2 steps to tackle debt.

Step 1 – Identify all debts, all payments and interest rates. Write them down clearly.

Step 2 – Pay down debt with surplus created by your budget improvements. Simple.

There are 2 ways to target debt identified:

- Smallest balance first (as you see progress and become more motivated)

- Largest interest rate first (as you are hitting the highest cost)

It’s your choice how you reduce debt (or even if you reduce debt) just make sure to identify it clearly so it can’t hide from you – then get moving.

Saving Cash & Emergency Fund

Aside from debt reduction, your surplus from your budget should be considered for building your savings and beginning to invest.

Your first savings account should be an Emergency Fund. Now you have your budget refined, you know your monthly expenses. Consider saving 1,2,3,6+ months in an emergency fund that is tucked away for a bad day.

Next you can save for big ticket items like cars, houses etc. It’s really up to you, but I’d encourage you to sort out the emergency fund first. This is your peace of mind. Then proceed from there. You will feel great once you start building this fund and that’s the key ingredient to do even more for yourself later.

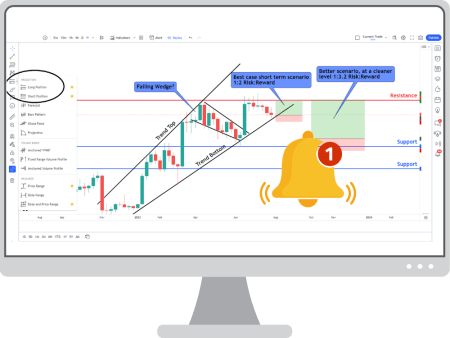

Investing & Trading

Do not get caught up in the high-horse morals of influencers on socials going to war over which is best – investing or trading. There is a general lack of understanding of the purpose of each activity, which certainly shows through those social accounts. Thats OK though, it’s easy to understand both activities with some simple explanation.

- Investing is for wealth building and it’s a passive activity for the most part.

- Trading is for cashflow and it’s an active activity (very active).

They are not the same thing. They are not better than one another. It’s like comparing apples and oranges – so skip the social drama about which is best and just consider them separately.

If you are just starting out, long term investing is the logical first step. This will allow you to begin building and growing the wealth you will need later. Its also potentially an inflation fighter activity (assuming your investment performs).

If you already have a strong long term investing base and are looking to earn extra cash, you can learn how to trade so you can produce cash for yourself (assuming you can trade well)

You choose. It’s also OK to do neither. Just go your own way with your own comfort level. If you really need help, that’s what a financial advisor is for.

Key Takeaways

- Financial independence requires building a strong personal finance base before making any significant progress.

- Avoid the temptation of “shiny object syndrome” and quick wins by prioritizing long-term focus and critical thinking.

- Assess your finances and make decisions as if you were assessing a business.

- Delayed gratification and restraint are essential skills to increase your net worth and prioritize wealth-building items over non-wealth-building ones.

- Adopting a minimalist mindset and getting excited about having money instead of things can help with delayed gratification.

- Practical budgeting through categorization can help you feel organized, in control, and purposeful while tracking both expenses and income.

- After gathering data, find ways to reduce expenses and increase income to improve your financial situation.

- Prioritizing financial goals over immediate wants can help you avoid impulse buying and make more thoughtful purchases.

- Achieving financial independence requires a combination of long-term planning, critical thinking, and disciplined execution.

- Building a strong financial base takes time and effort but is essential to achieving financial independence and creating a life of abundance and freedom.

Final Thoughts

It can be a bloody slow, frustrating grind of a process when you first start making financial progress. The budgeting is annoying, asking for discounts is embarrassing and every step is a slog. Taking on extra work is hard. Less sleep is hard. Getting up earlier or working later is hard. No doubt.

But, if you persist, you will begin to create small amounts of surplus cash by reducing expenses and increasing income.

Small surplus can be used to reduce debt, leading to bigger surplus. Bigger surplus can be used to provide yourself with emergency funds.

Emergency funds allow you to sleep at night and every day you become less burdened and more wealthy.

More wealth leads to investing, which compounds and leads to even more wealth.

It all starts with a strong personal finance base.

So get your house in order – and make some real progress.

More:

- Check out the Australian Gov Money Smart website

- Follow me on Twitter and LinkedIn

- Read Articles on finance, business, tech and more

Leave a Reply